Market Environment

Market Environment

Japanese companies have been steadily increasing their R&D and software expenditures for a long time. However, as technologies advance and the number of technical fields requiring development grows, companies have found it difficult to conduct R&D and software development by using in-house staff alone. Accordingly, a growing number of companies have chosen to use external resources. As a result, the technical human resource services market, centering on engineer dispatching, has continued to grow faster than R&D and software expenditures. In recent years, the pace of technological advancements in the automotive and IT sectors has been remarkable, and these investments continue to increase in such fields as AI, IoT, robotics, electric vehicles (EVs), energy saving and self-driving cars. According to a survey by the Nikkei, Japanese companies will increase their R&D expenditure by 4.5% year on year in the fiscal year ending March 31, 2019. This would be the ninth consecutive year of increases. R&D is a lifeline for corporate growth and is relatively unaffected by short-term economic fluctuations. However, the supply of workers in Japan is limited due to a shrinking working-age population, and the shortage of engineers is increasingly serious. Against this backdrop, the market for the outsourcing of design development, R&D and software development is expected to expand further.

Trends and Growth in the Engineer Staffing Market

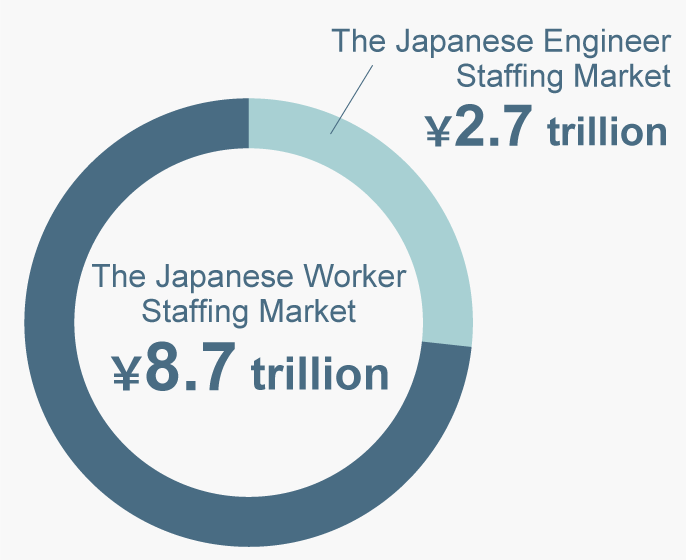

Out of a whole worker staffing market of approximately ¥8.7 trillion ($60 billion)*1(in 2022) in Japan, the engineer staffing market, which calls for workers with a high level of expertise such as engineers and researchers, is estimated at approximately ¥2.7 trillion ($18.6 billion)*2.

- *1, *2:TechnoPro Holdings based on“Results of Engineer Dispatching Business Report”and“Engineer Dispatching Business Status as of June 1, 2022,”Ministry of Health,Labour and Welfare

The Ten Companies in the Engineer Dispatch Market

The top five companies in Japan’s engineering professional services market, including the TechnoPro Group, are substantially larger than the next tier. Even so, as one of these leading companies the TechnoPro Group has a market share of only 7.6%. Going forward, small and medium-sized companies are expected to consolidate, providing plenty of growth opportunity among the industry’s largest firms.

| Rank | Company | Net Sales (Millions of Yen) |

Share |

|---|---|---|---|

| 1 | TechnoPro Holdings, Inc. (R&D Outsourcing / Construction Management Outsourcing) | 213,633 | 7.6% |

| 2 | BREXA Technology Inc. (FY23.12 financial figures of the former Outsourcing Inc.) | 162,459 | 5.7% |

| 3 | Open Up Group Inc. (Machinery, Electronics and IT Software / Construction) | 158,423 | 5.6% |

| 4 | MEITEC CORPORATION (Engineering Solutions Business) | 131,612 | 4.7% |

| 5 | PERSOL HOLDINGS CO., LTD. (Technology SBU) | 114,705 | 4.1% |

| 6 | WDB Holdings Co., Ltd. | 51,136 | 1.8% |

| 7 | Altech Corporation (The Outsourcing Business) | 45,754 | 1.6% |

| 8 | Forum Engineering Inc. | 34,688 | 1.2% |

| 9 | COPRO-HOLDINGS. Co., Ltd. | 30,015 | 1.1% |

| 10 | Nareru Group Inc. | 21,608 | 0.8% |

Sources:Data calculated and prepared by TechnoPro based on materials published by individual companies (used earnings information only from operations in Japan).

In addition to engineer dispatching, the TechnoPro Group undertakes contracting and meets outsourcing demand in other ways. Japan’s Information services industry has a value of ¥16 trillion. Outsourced development is itself a major market, with outsourcing costs accounting for ¥6 trillion*. Our research shows that 25% of IT engineers are working at client sites, and most of these people are not from engineers dispatch companies but from smaller IT companies. We have an opportunity to take this market from smaller IT outsourcing companies that lack resources and licenses.

*2018 Current Survey of Selected Service Industries, “Ministry of International Trade and Industry”

Shortfall in IT Workers

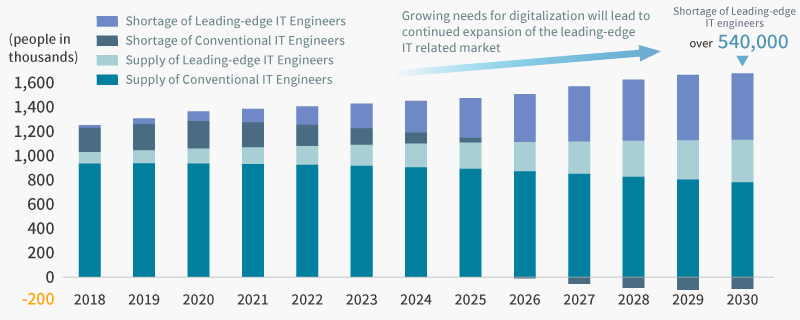

The shortage of engineers in the automotive and IT sectors, where the pace of technological innovation is increasing, is particularly prominent, and investments continue to grow in areas such as electric vehicles (EVs), autonomous driving, and energy saving, in addition to AI, IoT, and robotics.

In addition, according to the Ministry of Economy, Trade and Industry, “Survey report about supply and demand of IT talent”, the supply of IT engineers is estimated to be short by 540,000 by 2030 even under the medium scenario. For the TechnoPro Group, whose IT engineers account for more than 50% of its entire resource, the shortage of IT talent presents both a major challenge and an area for business growth.

Forecast Shortfall in IT Workers

Source: Ministry of Economy, Trade and Industry, “Survey report about supply and demand of IT talent (March 2019)“

Mismatch between Japanese Employment Practices and the Labor Market

A mismatch exists in the Japanese labor market. Even today, many large domestic companies maintain traditional Japanese hiring practices: hiring of new university graduates, seniority-based compensation, and lifetime employment. Under this system, young workers receive relatively low salaries, with wages rising with years of service. This system incentivizes workers to remain in the same company, but creates a mism atch between productivity and wages for mid-career hires. Japan’s labor market mobility is consequently low, leading to concerns that the country’s international competitiveness will fall. In addition, workers who wish to change careers may consider the risk too great and be unable to fully utilize their skills. Another mismatch between supply and demand occurs because new-graduate recruits tend to prioritize the stability of lifetime employment, so prefer to work at large companies. Companies, however, are incentivized to minimize such hiring because of difficulties in adjusting staffing levels. To address such mismatches, TechnoPro provides engineer staffing that shields individuals from the risk of career changes, while at the same time placing engineers in optimal positions for leveraging their skills and experience. In these ways, we are raising the market value of engineers and helping make Japanese companies more internationally competitive.

Seniority-Based Wages and Wages Based on Work Productivity (Hourly)

Source: “Equity Research Reprinted Report,” May 1, 2017, Investment Information Department, Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Note: Produced by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd., based on the “Basic Survey on Wage Structure,” Ministry of Health, Labour and Welfare, Naganuma and Nishioka (2014) and other materials

This curve of correspondence between worker productivity and wages was created by estimating worker productivity by age, looking at the proportionality of wages and productivity, and using trial calculations to hold total personnel costs at a constant level.

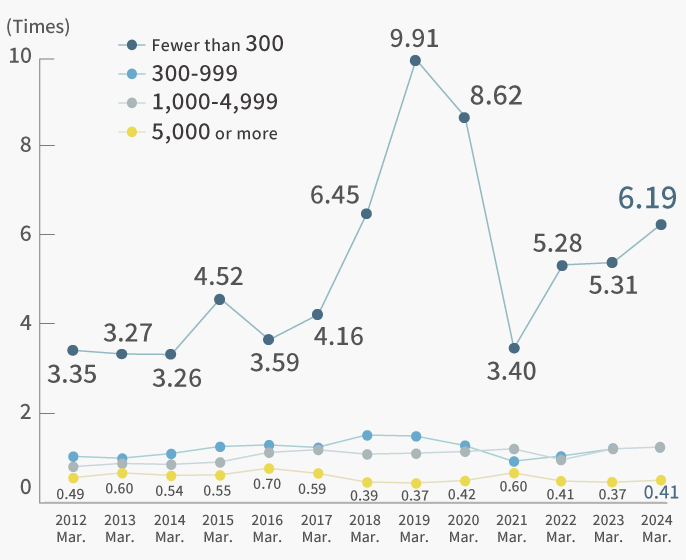

Worker productivity by age uses trial calculations based on estimates from the “Background for Changing Wages in Japan: Seniority-Based Wages and the Impact of the Aging Workforce” Naganuma and Nishioka (2014).Jobs-to-Applicants Ratio for College Graduates, by Scale Based on Number of Employees

Source: “38th College Graduates Job Opening Survey,” Recruit Works Institute

Rising Importance of Talents with Technological Expertise

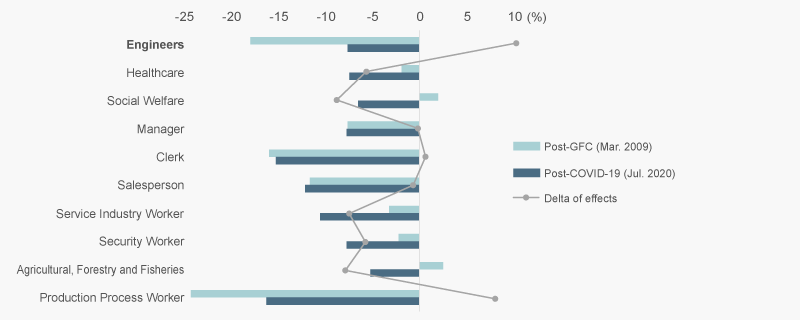

The engineering professional services industry continues to grow over the long term against the backdrop of growing demand for research and development and IT outsourcing. On the other hand, however, this industry is susceptible to economic fluctuation, and there has been concern that demand will decline significantly during recessions. Our group commissioned the Doshisha University STEM Human Resource Research Center to compare the impact of two external shocks, the Global Financial Crisis (GFC) and the pandemic of the novel coronavirus, on the number of new job openings six months after their occurrence by job category. The results showed that as of July 2020, six months after the start of the spread of the novel coronavirus in Japan, the decline in new job openings was more severe in many job categories than it was six months after the GFC, while the decline was significantly smaller for engineers.

Note: 1. The figure left shows the comparison of the effect from the Global Financial Crisis (GFC) and COVID-19 on the index data of new job offers for each job category after 6 months from the initial outbreak of the crisis

2. Figures in September 2008 was indexed as 100 for the GFC, figures in January 2020 was indexed as 100 for the COVID-19 pandemic (seasonally adjusted)

Source: Ministry of Health, Labor and Welfare, Labor “EMPLOYMENT REFERRALS FOR GENERAL WORKERS,” the Doshisha University Research Institute for STEM Human Resources, Commissioned by TechnoPro in 2020

This means that the decline in demand for engineers at the time of the GFC may have been excessive and that there may have been changes in the employment structure at the design and development sites, suggesting that the importance of engineers in the industries has increased due to the chronic shortage of engineers coupled with the significant progress of software adoption over the past 10 years.

Escalating Shortage of Engineers and Structural Challenges Japanese Engineers are Facing

The shortage of engineers in Japan is growing increasingly severe; one reason for the mismatch between supply and demand is that Japanese engineers receive low compensation relative to their counterparts overseas. According to a study the TechnoPro Group commissioned to Yoshifumi Tanaka, a professor at Doshisha University who specializes in research on the cultivation of STEM personnel, as of 2016 salaries of Japanese engineers were around 50% to 60% of US engineers.The study also found that, with a relative comparison of the salary differences in each country, in the United States, engineer salaries were 2.5 to 2.8 times higher than those paid to assemblers, while in Japan they are only 1.3 to 1.8 times. Since the Japanese employment system does not pay workers based on their job description, it is difficult to raise wages only for specific job categories even if there is a shortage of workers. This is one of the reasons that hinders improvement in the treatment of engineers in short supply, resulting in a shortage of workers. In this sense, the engineering professional services industry is also expected to play a role in helping to solve the shortage of engineers by establishing a professional labor market and improving their market value.